Corporate structure

Corporate structure

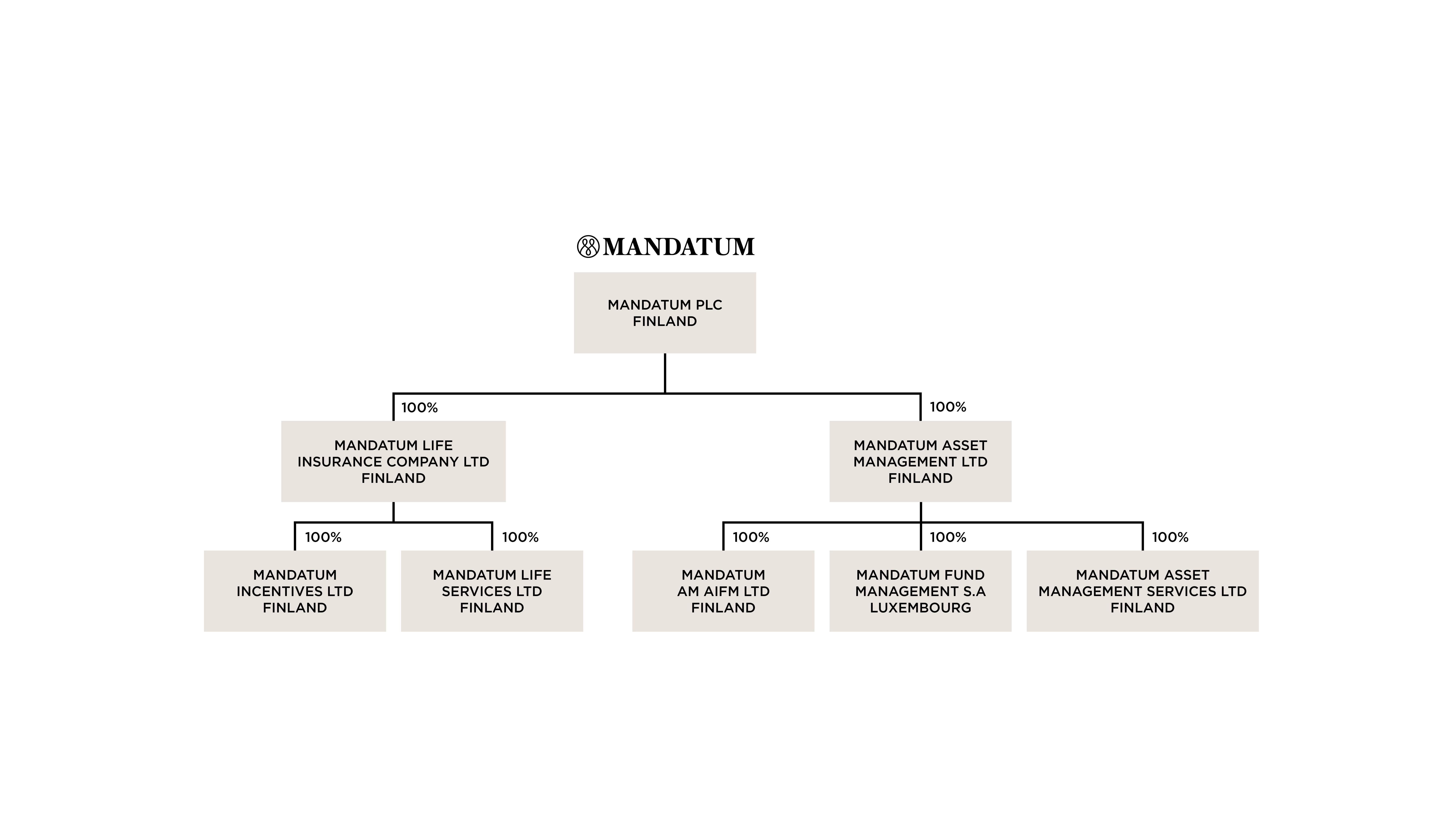

Legal structure of Mandatum Group

Read more: Organization of governance

Group companies

Mandatum plc is an insurance holding company, which conducts its business through its subsidiaries. Mandatum Life (Mandatum Life Insurance Company Limited) offers services in wealth management, rewards and compensation, retirement plans and personal insurance to private and corporate customers. Mandatum Asset Management is an investment firm, which combines fund business, discretionary and consultative wealth management, and asset management services.

Mandatum Life

Mandatum Life (Mandatum Life Insurance Company Limited) and its Group companies offer services in wealth management, rewards and compensation, retirement plans and personal insurance to private and corporate customers. Mandatum Life is a wholly-owned subsidiary of Mandatum plc. Mandatum Life is made up of Mandatum Life Services Ltd and Mandatum Incentives Ltd. Mandatum Life Insurance Company Limited is a wholly-owned subsidiary of Mandatum Group and a sister company to Mandatum Asset Management Ltd.

The Chair of Mandatum Life’s Board of Directors is Petri Niemisvirta, and the company’s President and Managing Director is Jukka Kurki.

Mandatum Life’s Annual Report 2022

Mandatum Life’s subsidiaries

Mandatum Life Services Ltd

Mandatum Life Services Ltd is a subsidiary of Mandatum Life and an insurance intermediary registered with the Finnish Financial Supervisory Authority, which provides reward consulting services and personnel fund management services to companies and organisations, pension services to companies and pension funds, and securities trading services as Saxo Bank A/S’s tied agent through the Trader service offered by Saxo Bank A/S.

Trader is a securities trading service offered by Saxo Bank A/S, which Mandatum Life Services represents in Finland. Mandatum Life Services Ltd acts as Saxo Bank A/S’s tied agent and is responsible for Trader’s Finnish customer service, client identification and service marketing. Saxo Bank is responsible for trading within the service, regulatory reporting and custodial services for securities. When using Trader, a customer account is established with Saxo Bank.

Learn more about our services:

Reward & Compensation Services »

Mandatum Incentives Ltd

Mandatum Incentives Ltd specialises in equity-based incentive schemes. It designs and implements incentive, retention and reward and compensation schemes, offers related consultation services and provides various remuneration analyses and reward and compensation policies and reports.

Learn more about Mandatum Incentives’ services »

Mandatum Asset Management

Mandatum Asset Management’s (Mandatum Asset Management Palvelut Oy, MAM) mission is to serve institutional and other professional investor clients, offer funds and asset management services to both its own and Mandatum Life’s clients and manage the Group’s investment assets. Mandatum Asset Management also acts as an insurance intermediary registered with the Finnish Financial Supervisory Authority for Mandatum Life.

Mandatum Asset Management manages approximately EUR 15 billion in investment assets, allocated across the company’s core competence areas: corporate loan investments, alternative investments and equity investments based on active selection.

The Chairman of the company’s Board of Directors is Patrick Lapveteläinen. Antti Sorsa is the company’s interim Managing Director.

Mandatum Asset Management’s Annual Report 2022

Mandatum Asset Management’s subsidiaries

Mandatum AM AIFM Ltd

Mandatum AM AIFM Ltd has authorisation from the Finnish Financial Supervisory Authority to manage alternative funds investing in the property strategy and private equity investment strategy. Mandatum AM AIFM manages Mandatum AM Finland Properties II, which invests in Finnish real estate, and the MAM Growth Equity II fund, which makes growth investments in scalable Nordic growth companies.

More information on products managed by AIFM can be found here.

Emilia Riikonen is the Managing Director of Mandatum AM AIFM Ltd.

Mandatum Asset Management Services Ltd

Mandatum Asset Management Services Ltd is Mandatum Asset Management’s subsidiary, which offers, either itself or through its subsidiaries, wealth management services to alternative funds with regard to the real estate funds they manage, and other services related to the operational management of real estate and other assets.

Mandatum Fund Management S.A.

Mandatum Fund Management S.A. is a wholly-owned subsidiary of Mandatum Asset Management and manages Mandatum Asset Management’s UCITS funds registered in Luxembourg.