Purpose

Purpose

Mandatum’s key success factor is targeting its diverse service offering precisely to the situations and needs of different client segments. With this operating model, the company aims to keep generating added value both for clients and Mandatum’s own business. Mandatum’s skilled sales and customer relations personnel is its main strength in the distribution of products and services.

Mandatum offers a wide range of mutually complementary products and services for its institutional & wealth management, corporate and retail clients. Mandatum is one of Finland’s leading financial service providers and has institutional clients also in Sweden and Denmark. In total, Mandatum has around 20,000 corporate and 330,000 retail clients.

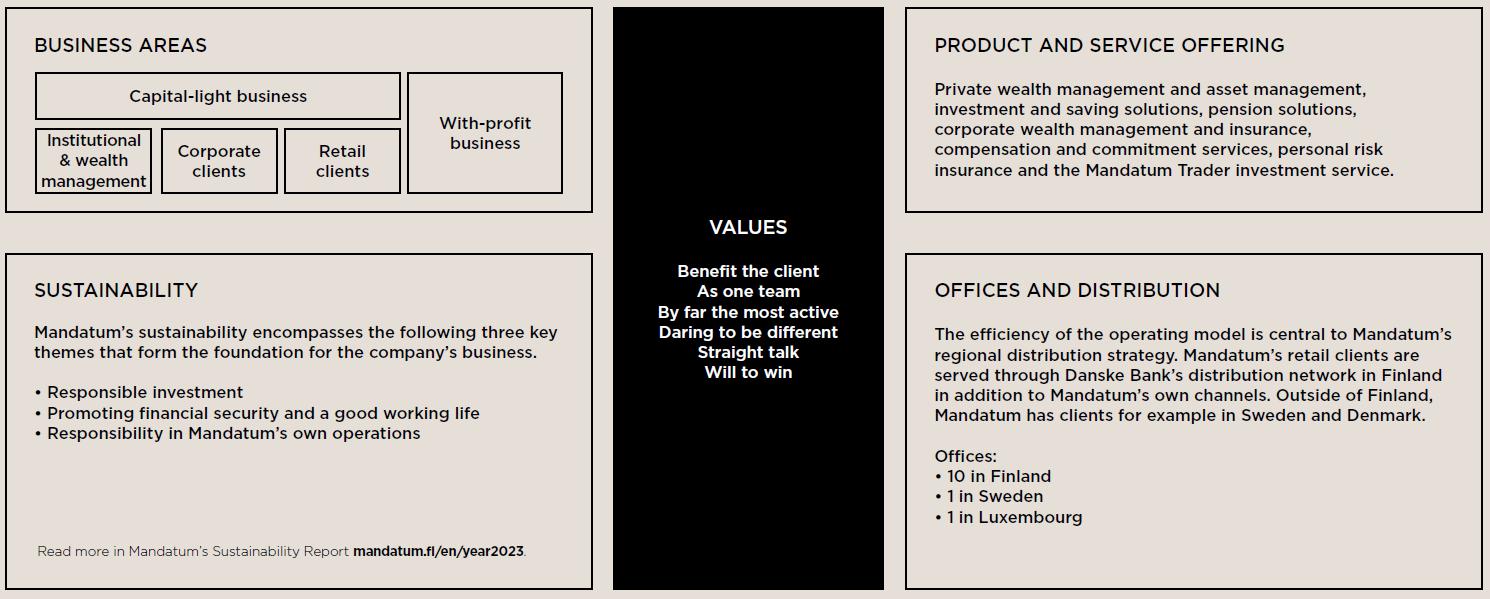

Business areas

Institutional & wealth management

Mandatum provides comprehensive wealth and asset management services to its clients, which include Finnish and Nordic institutional investors, corporations and high-net-worth individuals. The company's investment expertise is based on long experience and a strong track record for profit, especially in the credit and alternative investments. Mandatum has been able to generate attractive risk-adjusted returns for its clients in a variety of asset classes.

Corporate clients

Mandatum serves corporate clients in two main segments: large and medium-sized clients and entrepreneur-driven clients. For small businesses and entrepreneurs, Mandatum primarily offers preparing and prospering services, while for large and medium-sized companies the focus is on incentive schemes and compensation, including personal and pension insurance and personnel funds.

Mandatum is the clear market leader in supplementary pensions and personnel funds and has a strong position in personal insurance. We have extensive contacts with Finnish business leaders, since the end customers of these products and services consist of the management and employees of Finnish companies. This enables the cross-selling of products and services as part of the customer relationship.

Retail clients

Mandatum offers investment solutions and personal insurance to retail clients. Danske Bank is the main distribution channel for retail clients’ solutions. The services are also available directly through Mandatum's own sales force and digital channels. In addition, Mandatum has selected partnerships for example with associations.

With-profit business

The with-profit business area includes the management of the with-profit insurance portfolio and management of assets covering the with-profit liabilities and assets covering Mandatum Life’s shareholders’ equity. The target for investments is to generate returns above the insurance contract liabilities requirements at moderate risk, while at the same time decreasing the insurance portfolio releases capital.

The majority of current with-profit insurance policies are pension insurance policies sold in the 1980s and 1990s. These policies include a fixed guaranteed return of mainly 3.5 or 4.5 per cent. The insurance contract liabilities in the financial statements have been calculated using the up-to-date market-consistent interest rate, which takes into account the guaranteed returns to be paid on the policies in the future. The sale of such policies was discontinued in the early 2000s, and the insurance portfolio is expected to continue decreasing relatively sharply in the coming years.

Product and service offering

Private wealth management and asset management, investment and saving solutions, pension solutions, corporate wealth management and insurance,

compensation and commitment services, personal risk insurance and the Mandatum Trader investment service.

Sustainability

Mandatum’s sustainability encompasses the following three key

themes that form the foundation for the company’s business.

• Responsible investment

• Promoting financial security and a good working life

• Responsibility in Mandatum’s own operations

Offices and distribution

Mandatum’s retail clients are served through Danske Bank’s distribution network in Finland in addition to Mandatum’s own channels. Outside of Finland, Mandatum has clients for example in Sweden and Denmark.

Offices:

• 10 in Finland

• 1 in Sweden

• 1 in Luxembourg

Business partners

In addition to its own customer service, Mandatum serves its customers through Danske Bank. The insurance policies sold to Mandatum’s private customers are largely distributed through the partnerships made with Danske Bank to effectively reach a large number of customers in the target group. Danske Bank sells Mandatum’s risk insurance and savings products to all of the private customer segments. Korkia manages a small share of Mandatum’s private customer portfolio, which consists of individual pension insurance.

Mandatum co-operates closely with Kaleva Mutual Insurance Company. Mandatum acts as Saxo Bank’s sole tied agent in Finland by offering Saxo Bank’s trading platform to its customers through the Mandatum Trader service.

Mandatum Asset Management Ltd offers discretionary and consultative asset management for institutional and other professional investors. MAM also acts as a distributor for the investment funds of its subsidiaries and certain co-operation partners. These investment funds are mainly open to professional investors.