Mandatum as an investment

Mandatum as an investment

An expert in money and life

Mandatum is one of Finland’s leading financial service providers. It combines expertise in money and life. The company’s expected growth is enabled by a strong market position, a renowned brand, highly competent personnel and successful investments. Mandatum is well-positioned to promote its potential future growth and value creation.

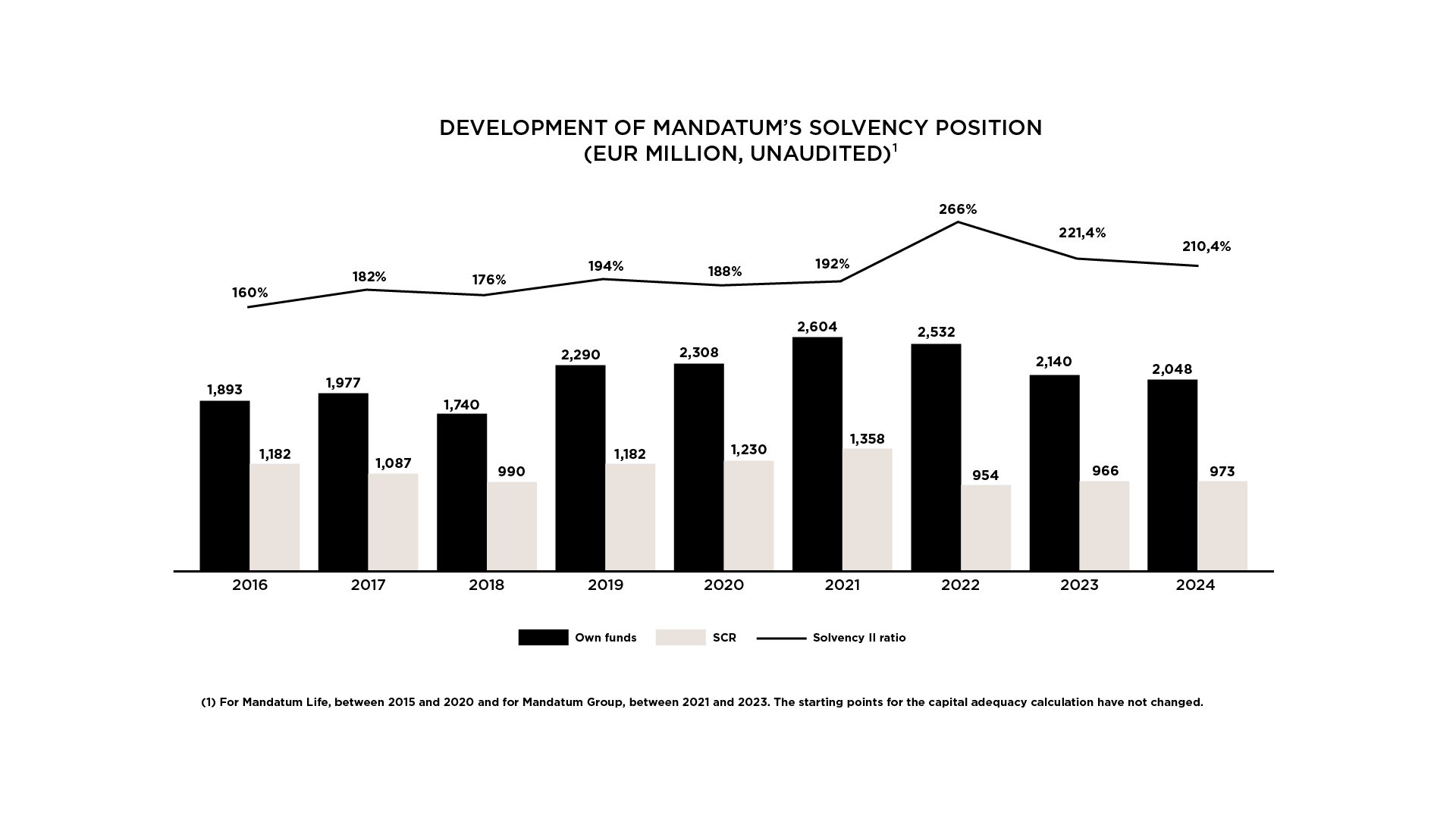

1. Solid solvency position and attractive dividend

Mandatum's aim is to be a good dividend payer – both now and in the future. As part of its financial targets, Mandatum aims the cumulative shareholder payouts to be exceeding EUR 1 billion for years 2025–2028. Mandatum looks to achieve a good investment result with moderate risk and profitable growth from capital-light business. Together with the capital released from the with-profit business, this lays a solid foundation for an attractive dividend flow as well as added potential for additional distribution of profits.

2. Profitable growth from wealth management

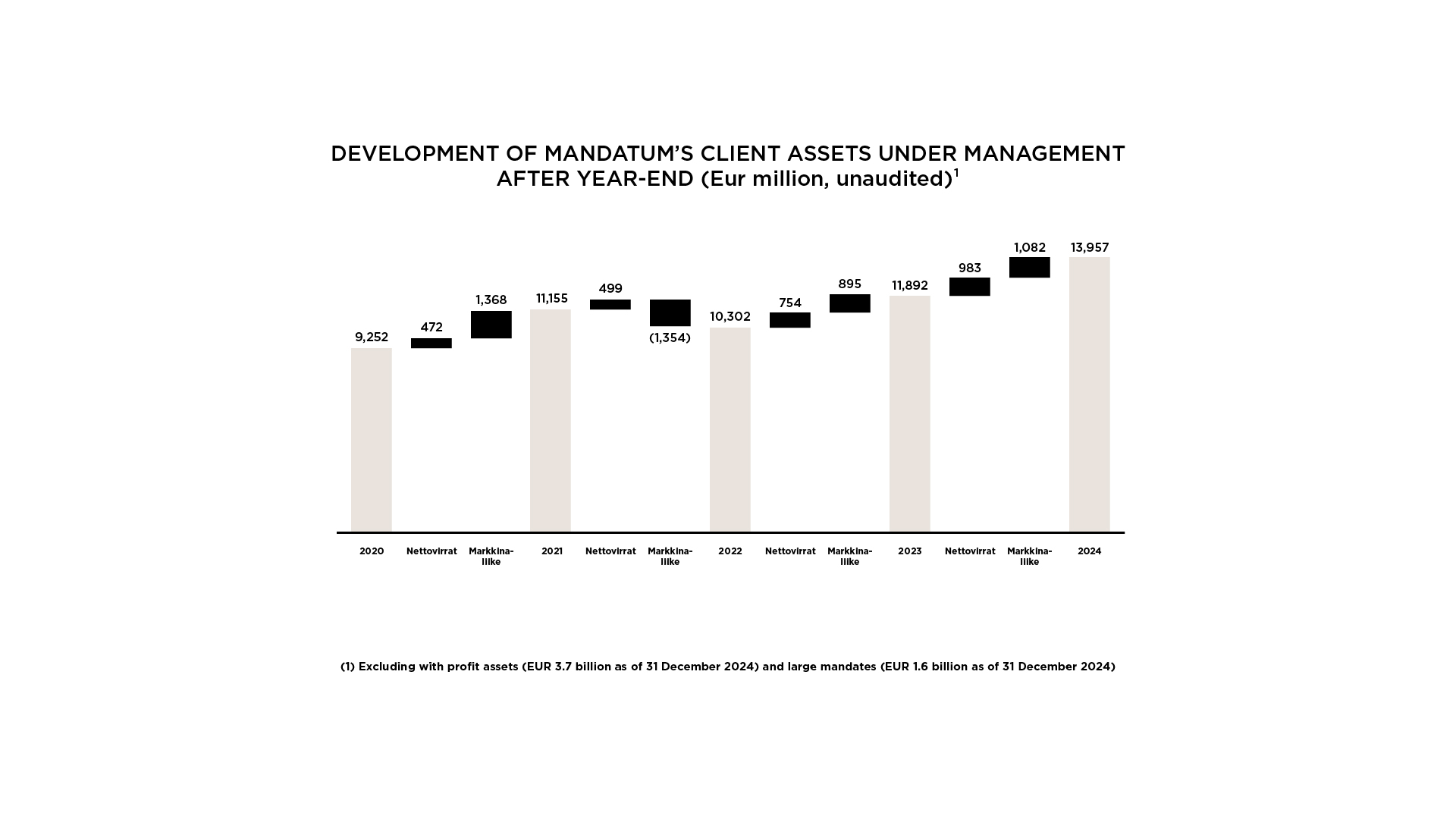

The Institutional & wealth management business area is the driver of Mandatum’s growth. Its clients include Finnish and Nordic institutional clients as well as high-net-worth individuals. Strong investment expertise and a proven track record, especially in our own spearhead products in the fixed income and credit markets, support our growth strategy and help expand the business to other Nordic countries.

3. Market leadership in the corporate segment enables cross-selling in wealth management

A strong market position in the corporate segment also means extensive contacts with Finnish business leaders, which enables the cross-selling of wealth management products and access to significant new customer flows. Approximately 70 per cent of Mandatum’s private wealth management clients currently have some kind of business connection. Mandatum offers the most extensive remuneration and engagement services on the market for corporate clients.

4. A strong brand and high customer and employee satisfaction

Mandatum’s well-known brand, proven customer and personnel satisfaction and sales-oriented culture support all business activities and create added value in relation to competitors.

Mandatum in figures

Client assets under management EUR 14.0 billion

(31 Mar 2025)

Net flow EUR 255.6 million

(1 Jan 2024−31 Mar 2025)

Capital-light profit before taxes EUR 19.9 million

(1 Jan 2025−31 Mar 2025)

Profit before taxes EUR 62.0 million

(1 Jan 2025−31 Mar 2025)

Solvency ratio 207.4%

(31 Mar 2025)

Mandatum’s business consists of four segments

Institutional & wealth management is a driver of growth

Mandatum provides comprehensive wealth and asset management services to its clients, which include Finnish and Nordic institutional investors, corporations and high-net-worth individuals. The company's investment expertise is based on long experience and a strong track record for profit, especially in the credit and alternative investments. Mandatum has been able to generate attractive risk-adjusted returns for its clients in a variety of asset classes.

Read more on Mandatum’s Annual Report 2024

Market leader in corporate clients

Mandatum serves corporate clients in two main segments: large and medium-sized clients and entrepreneur-driven clients. For small businesses and entrepreneurs, Mandatum primarily offers preparing and prospering services, while for large and medium-sized companies the focus is on incentive schemes and compensation, including personal and pension insurance and personnel funds.

Mandatum is the clear market leader in supplementary pensions and personnel funds and has a strong position in personal insurance. We have extensive contacts with Finnish business leaders, since the end customers of these products and services consist of the management and employees of Finnish companies. This enables the cross-selling of products and services as part of the customer relationship.

Read more on Mandatum’s Annual Report 2024

We serve retail clients directly and through our partners

Mandatum offers investment solutions and personal insurance to retail clients. Danske Bank is the main distribution channel for retail clients’ solutions. The services are also available directly through Mandatum's own sales force and digital channels. In addition, Mandatum has selected partnerships for example with associations.

Read more on Mandatum’s Annual Report 2024

The decrease of the with-profit portfolio releases capital

The With-profit business area includes the management of the with-profit insurance portfolio and management of assets covering the with-profit liabilities and assets covering Mandatum Life’s shareholders’ equity. The target for investments is to generate returns above the insurance contract liabilities requirements at moderate risk, while at the same time decreasing the insurance portfolio releases capital.

Read more on Mandatum’s Annual Report 2024

Value drivers

Mandatum’s key value drivers are:

- fee result

- net finance result

- result related to risk policies

- capital release

Fee result and result related to risk policies are the key value drivers for capital-light business while with-portfolio is especially driven by net finance result and capital release.